Ppp Loan Requirements 2025 Lok

Ppp Loan Requirements 2025 Lok. For these new loans, any amount not forgiven becomes a loan at 1% for five years. Application process for ppp loan forgiveness 2025.

The new guidance released includes: To be eligible for loan forgiveness, ppp borrowers must use at least 60% of the loan proceeds for payroll costs, including salary, wages, tips, and benefits.

Ppp Loan Requirements 2025 Lok Images References :

Source: www.slideteam.net

Source: www.slideteam.net

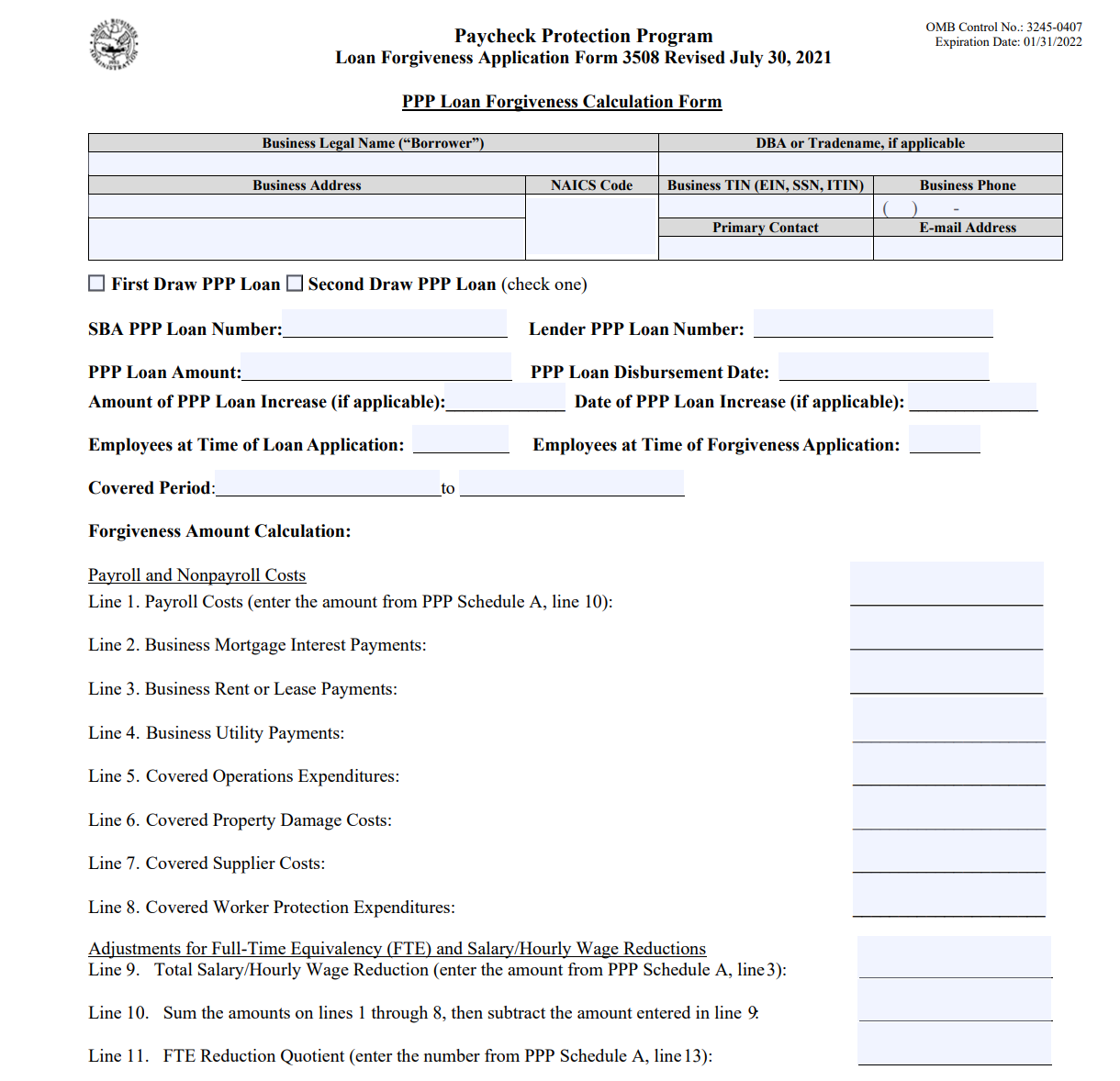

PPP Loan Requirements Ppt Powerpoint Presentation Infographics Samples, Paycheck protection program (ppp) loan forgiveness:

Source: blanker.org

Source: blanker.org

SBA Form 3508. PPP Loan Application Forms Docs 2025, To qualify for full loan forgiveness, businesses must use at least 60% of the loan amount for payroll costs.

Source: economydiva.com

Source: economydiva.com

Will PPP Loans Be 2025, New delhi, jul 23 (pti) finance minister nirmala sitharaman on tuesday said the loan limit under the mudra scheme will be doubled to rs 20 lakh.

Source: www.producthunt.com

Source: www.producthunt.com

PPP Loan Search Product Information, Latest Updates, and Reviews 2025, Eligible borrowers include small businesses, nonprofits,.

Source: helloskip.com

Source: helloskip.com

Here's Who's Been Approved for PPP Loans So Far, Key factors of ppp loans first round.

Source: caitlinmorgan.pages.dev

Source: caitlinmorgan.pages.dev

Ppp Program Nj Payment Schedule 2025 Dina Myrtia, In order to obtain a paycheck protection program (ppp) loan, section 1102 (g) of the coronavirus aid, relief and economic security (cares) act, requires that an.

Source: www.youtube.com

Source: www.youtube.com

PPP Second Draw Loan Requirements YouTube, To qualify for full loan forgiveness, businesses must use at least 60% of the loan amount for payroll costs.

.jpg) Source: www.mossadams.com

Source: www.mossadams.com

PPP Loan Expanded Eligibility and Deadlines for NFPs, This holland & knight alert addresses the key considerations for employers seeking forgiveness of ppp loans.

Source: www.edgebusinessplanning.com

Source: www.edgebusinessplanning.com

SBA Guidelines on PPP Loans, Economic aid to hard small businesses, nonprofits, and venues act.

Source: smallbiztrends.com

Source: smallbiztrends.com

PPP Loan FAQs for Small Business Small Business Trends, Employers are potentially eligible for a new round of.

Posted in 2025